When it comes to betting, managing risk is crucial. Whether you are a seasoned bettor or just starting out, understanding how to effectively manage your risk can make all the difference in your success. One of the most popular and effective methods for managing risk in betting is the Kelly Criterion.

What is the Kelly Criterion?

The Kelly Criterion is a mathematical formula that helps bettors determine the optimal size of their bets based on their edge and the odds offered by the bookmaker. Developed by John L. Kelly Jr. in the 1950s, the Kelly Criterion takes into account both the bettor’s advantage (edge) and the odds of the bet.

How Does the Kelly Criterion Work?

The Kelly Criterion formula is quite simple:

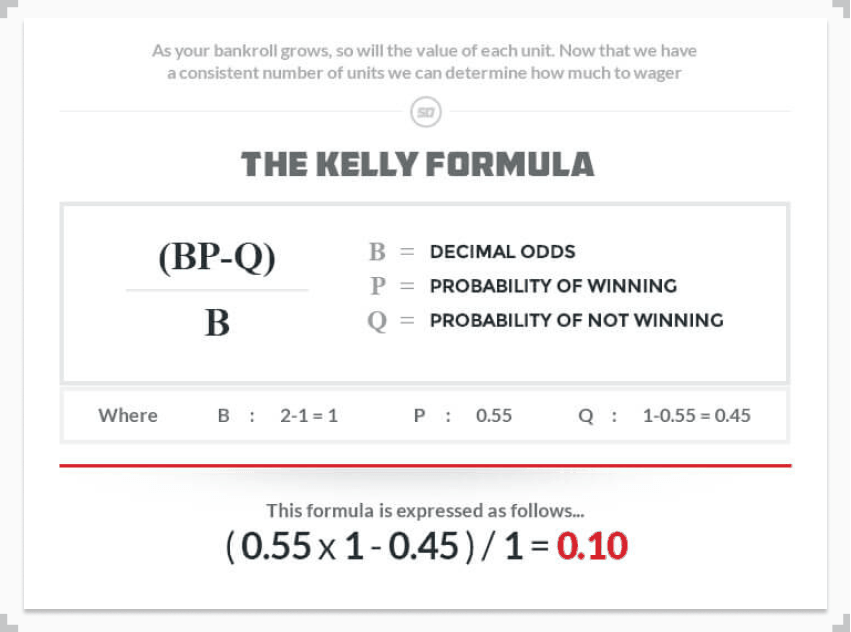

f* = (bp – q) / b

Where:

f* is the fraction of the bankroll to bet;

b is the odds received on the bet;

p is the probability of winning;

q is the probability of losing, which is equal to 1 – p.

By plugging in the values for b, p, and q, bettors can determine the optimal size of their bets to maximize their long-term profits while minimizing their risk of ruin.

Advantages of the Kelly Criterion

There are several advantages to using the Kelly Criterion for managing risk in betting:

Maximizes long-term growth: By betting the optimal fraction of your bankroll, you can maximize your long-term growth potential.

Minimizes risk of ruin: The Kelly Criterion helps bettors avoid going broke by taking into account the probability of losing.

Adaptable to changing circumstances: The Kelly Criterion can be adjusted based on changes in edge or odds, making it a flexible strategy for managing risk.

Disadvantages of the Kelly Criterion

While the Kelly Criterion is a powerful tool for managing risk in betting, it does have some limitations:

Requires accurate edge estimation: In order to use the Kelly Criterion effectively, bettors must accurately calculate their edge in a given bet.

No consideration for variability: The Kelly Criterion assumes a constant edge and does not take into account the variability of returns.

Can be aggressive: The Kelly Criterion can lead to large bet sizes, which may be too aggressive for some bettors.

Implementing the Kelly Criterion

To implement the Kelly Criterion in your betting strategy, follow these steps:

Calculate your edge: Determine the probability of winning and the odds offered by the bookmaker to calculate your edge.

Plug the values into the formula: Use the Kelly Criterion formula to calculate the optimal fraction of your bankroll to bet.

Adjust your bet size: Bet the calculated fraction of your bankroll on each bet to maximize your long-term profits.

Conclusion

The Kelly Criterion is a powerful tool for managing risk in betting. By accurately calculating your edge and using the Kelly Criterion formula, you can optimize your bet sizes to maximize your long-term profits while minimizing your risk of ruin. While the Kelly Criterion does have limitations, it remains one of the most popular and effective methods for managing risk in betting. Incorporating the Kelly Criterion into your betting strategy can help you become a more successful and profitable bettor.